Bajaj group, when you hear this what appears to your mind?

Bajaj finserv, Bajaj finance, Bajaj alliance life insurance company (BALIC) , Bajaj alliance general insurance company (BAGIC) ?

or

Bajaj pulsar, avenger, platina, Bajaj chetak scooter or your favorite KTM duke ?

What if I tell you one company which holds these above companies as subsidiary or associates.

Yes, you heard that right.

That one company is "Bajaj holding and investment ltd"

BHIL acts as a parent company of all Bajaj group of companies.

But then you will tell Bajaj Finserv, Bajaj finance and Bajaj Auto, These trident are nifty 50 companies.

You may call these, Bahubali's of nifty 50.

Why I call such, you will know later.

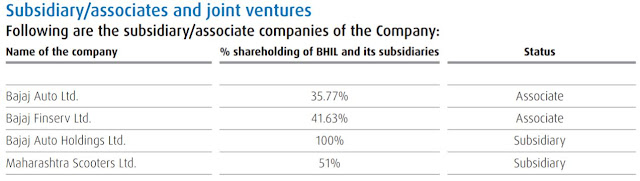

Now lets understand, how many percentage Bajaj holdings and investment holds in bajaj group companies?

* Percentage Holding lower than 50 % calls associate and more than 50 call subsidiary.

Bajaj Holdings & Investment Ltd. (‘BHIL’ or ‘the Company’) is registered with the Reserve Bank of India as a Non-Banking Financial Company – Investment and Credit Company (NBFC-ICC). BHIL is a part of BSE 200 and Nifty 200 index of top 200 companies listed in India. BHIL is essentially a holding and investment company and does not have any other operations of its own. The Company’s investments consist of:

a. Strategic investments in group companies: As on 31 March 2021, BHIL and its subsidiaries, held strategic stakes of:

35.77% in Bajaj Auto Ltd. (BAL),

41.63% in Bajaj Finserv Ltd. (BFS),

51% in Maharashtra Scooters Ltd. (MSL),

and

Other group companies such as Bajaj Electricals Ltd., Mukand Ltd. and Hercules Hoists Ltd.

b. Financial investments in capital markets and investment in properties: As on 31 March 2021, the Company held investments in equity and fixed income securities and investment in properties to the tune of ` 9,403 crore at market value.

The market value of the entire investment portfolio of BHIL stood at 109,209 crore as compared to the cost of ` 9,920 crore as on 31 March 2021.

Bajaj Auto Limited which manufactures and sells motorcycles and commercial vehicles is The World’s Favourite Indian with presence in about 80 countries.

Bajaj Finserv Limited is the holding company for various financial services businesses under the Bajaj Group.

It participates in the financing business through its 52.74% holding in Bajaj Finance Ltd. (BFL) and in the protection and savings businesses through its 74% holding in two unlisted subsidiaries, Bajaj Allianz General Insurance Company Ltd. (BAGIC) and Bajaj Allianz Life Insurance Company Ltd. (BALIC).

BAL, BFS and BFL are included in the benchmark BSE Sensex and Nifty 50 index of large cap stocks.

BHIL came into existence post the demerger of erstwhile Bajaj Auto Ltd. into three entities – Bajaj Auto Ltd., Bajaj Finserv Ltd. and the erstwhile Bajaj Auto Ltd. (renamed as Bajaj Holdings & Investment Ltd.), with effect from 1 April 2007.

0 Comments